With so many options on the market, selecting the best finance chatbot for your business can be daunting.

Worry not. I am here to help!

As a seasoned industry professional with years of experience, I’ve curated a list of the top 7 finance chatbots for 2025.

Let’s get started!

| Finance Chatbot | Best For | Plan |

|---|---|---|

| ProProfs Chat | Artificial Intelligence and Bot Performance Report | Forever-free for a single operator. Paid plan starts at $19.99/operator/month. |

| Ultimate.ai | Chat Automation | Custom pricing. |

| AlphaChat.ai | Integration | Starts at $440/month. |

| Kasisto | Large Language Model (LLM) Support | Custom pricing. |

| Haptik | Smart Budgeting Tool | Custom pricing. |

| Collect.chat | Multilingual Support | A free plan is available. Paid plan starts at $24/month. |

| Kore.ai | Voice Functionality | Starts at $1.72/conversation. |

Top 7 Finance Chatbots for 2025

This list is backed by my personal experience with these tools. Additionally, I’ve incorporated recommendations from experts in the field and trusted review sites.

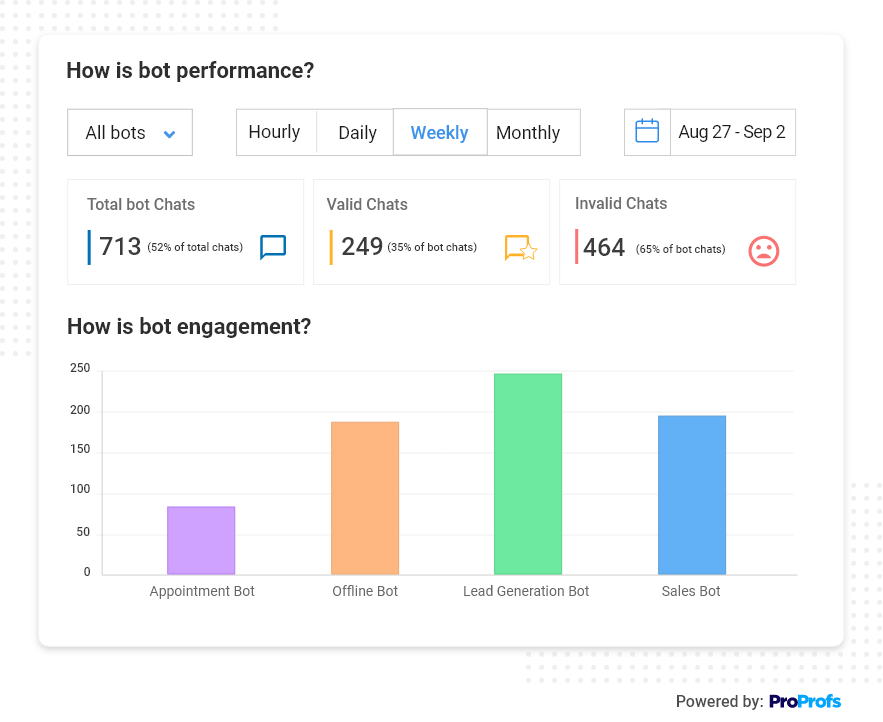

1. ProProfs Chat

Best for Artificial Intelligence and Bot Performance Report

As a financial advisor, I need to communicate with my clients. I started using ProProfs Chat, which turned out to be a powerful and easy-to-use chatbot platform helping me provide personalized and professional financial advice.

ProProfs Chat allows me to create and customize chatbots for different scenarios, such as booking appointments, answering FAQs, and providing quotes.

One of the best features of ProProfs Chat is its bot performance report. This feature enables me to monitor and analyze the performance of my chatbots, such as their response time, accuracy, satisfaction, and conversion rate. I can also get insights and suggestions on improving my chatbots and optimizing their results.

I also like how ProProfs Chat utilizes artificial intelligence to provide fast and accurate responses to my customers after analyzing the intent of their queries. I highly recommend it to anyone who needs a reliable and smart chatbot for financial services.

What you’ll like:

- Automated greetings and announcements for proactive engagement.

- Ready-to-use templates for lead generation, sales, customer support, ticketing, etc.

- Chat transcripts to access past customer conversations for a better understanding.

- Integration with CRM to route contact information directly to the centralized depository.

What you may not like:

- Frequent updates on the AI chatbot can get overwhelming for new users.

- The free plan is limited to a single operator.

Pricing: Forever-free for a single operator. Team plan starts at $19.99/operator/month.

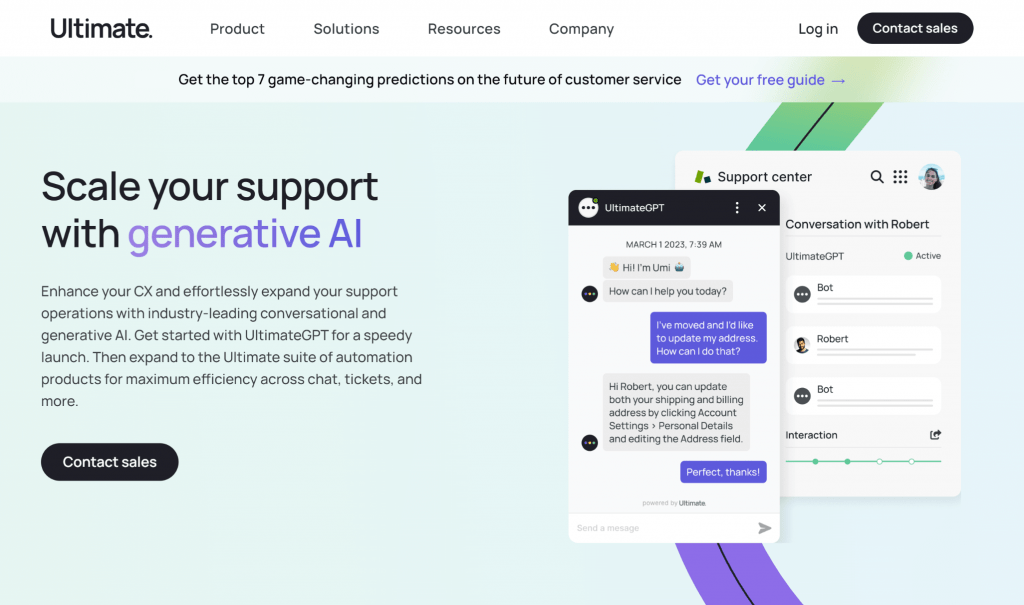

2. Ultimate.ai

Best for Chat Automation

I used Ultimate.ai during the initial phase of my professional career. Hiring and training human agents was costly and time-consuming. That’s why I decided to use Ultimate.ai, a chatbot platform that specializes in finance.

Ultimate.ai helped me automate most customer interactions, such as answering FAQs, booking appointments, verifying transactions, and providing financial advice. The chatbot was easy to set up and integrate with my existing systems. It also learned from my data and feedback and improved its performance.

With Ultimate.ai, I could reduce operational costs, increase customer satisfaction, and generate more leads and conversions. Ultimate.ai was the best investment I ever made for my business.

What you’ll like:

- Multilingual support to cater to a global audience.

- Secure chatbot solution that adheres to data protection regulations.

- Seamless integration with popular platforms like Zendesk, Salesforce, and Shopify.

- Advanced analytics and reporting to measure chatbot performance and customer satisfaction.

What you may not like:

- The platform lacks some features, such as voice support and sentiment analysis.

- The platform has some bugs and glitches that affect the chatbot’s performance.

Pricing: Custom pricing.

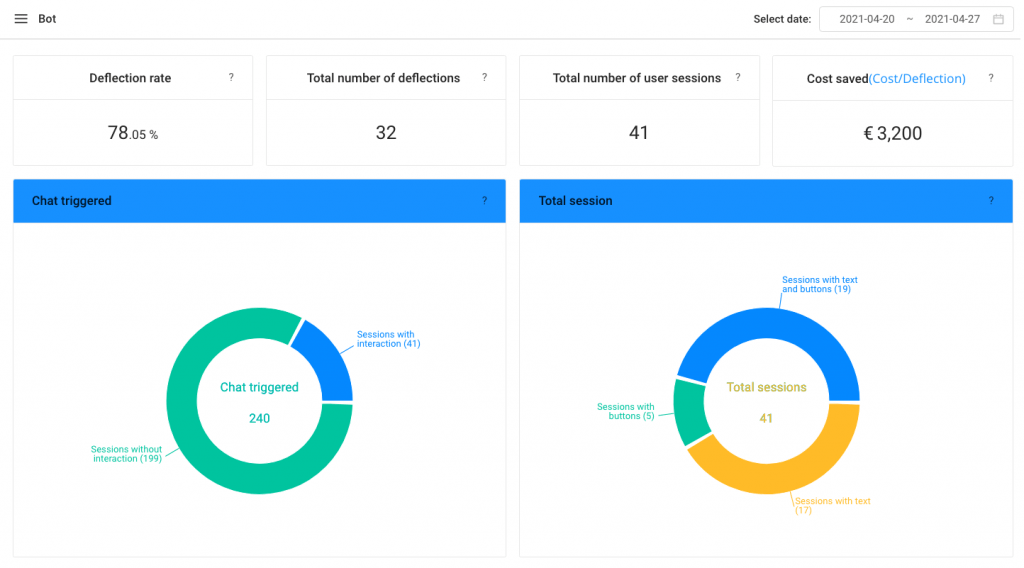

3. AlphaChat

Best for Integration

AlphaChat is a finance chatbot I used to automate and streamline customer service. I loved how easy it was to set up and integrate with my existing platforms, such as WhatsApp, Facebook Messenger, and Telegram. I could also customize it to match my brand identity and tone of voice.

AlphaChat helped me to provide faster and more accurate responses to my customers’ queries, such as account balance, transaction history, payment options, and financial advice. It also used natural language processing and machine learning to understand the context and intent of the conversations and to handle complex and multi-turn dialogues.

AlphaChat was an excellent tool for improving my customer satisfaction and retention and reducing my operational costs and workload. I would recommend it to anyone looking for a smart and reliable finance chatbot solution.

What you’ll like:

- Bot sharing with colleagues via ready-made URL.

- Auto prediction of topics for each customer message.

- Rich media support to add images, videos, and carousels.

- Smart handover of chats from bots to agents for advanced support.

What you may not like:

- Highly expensive plans as compared to other chatbot platforms.

- The platform has some issues with the integration with third-party systems and channels.

Pricing: Starts at $440/month.

Also Read: 7 Best Finance Chatbots to Boost Your ROI in 2025

4. Kasisto

Best for Large Language Model (LLM) Support

I wanted to provide my customers with a seamless and personalized banking experience. That’s why I chose Kasisto, a financial AI chatbot that specializes in finance. Kasisto’s chatbot, KAI, was easy to integrate with my existing systems and channels.

KAI helped me offer 24/7 support and guidance to my customers, who could ask questions, make payments, review account details, and manage their funds from multiple accounts using natural language.

KAI also impressed me with its advanced features, such as KAI-GPT, which leverages large language models to generate natural and relevant responses, and KAI Answers, which provides accurate and contextual information from various sources.

I highly recommend Kasisto to any financial institution looking for a smart and reliable conversational AI solution.

What you’ll like:

- Centralized monitoring of digital assistant performance.

- Omnichannel delivery for broader customer coverage.

- Live chat integration for assistance during complex inquiries.

- Multi-tenant architecture to serve multiple brands simultaneously.

What you may not like:

- Slower customer support.

- A steep learning curve for new users.

Pricing: Custom pricing.

Also Read: Chatbots 101: Why You Need Them and How to Embed Chatbots in Website

5. Haptik

Best for Smart Budgeting Tool

Haptik was recommended to me by an industry peer, and I couldn’t thank him enough. Haptik integrated seamlessly with various platforms and channels, such as websites, apps, and messaging apps.

Haptik leverages natural language processing and artificial intelligence to understand customer queries and give them relevant and personalized advice. Haptik also helped me track and analyze customer behavior, preferences, and feedback. It offered a range of features that helped me differentiate my business from other competitors.

One of the features that I liked the most was its smart budgeting tool. It helped customers create realistic and flexible budgets based on their income and spending patterns. It also alerted them when they were overspending or undersaving and gave them tips on how to improve their habits.

Haptik is more than just a chatbot. It is a financial solution that helps businesses increase customer satisfaction, loyalty, and retention.

What you’ll like:

- Chatbot collaboration features to work with your team and customers.

- Chatbot testing and debugging tools that ensure your chatbot quality and accuracy.

- Smart chatbot routing and escalation to connect users to the right agent or department.

- Pre-built chatbot templates and use cases for finance, insurance, e-commerce, and more.

What you may not like:

- Limited customization options as compared to other finance chatbots.

- The platform has frequent downtime and maintenance, which affects the chatbot’s availability and reliability.

Pricing: Custom pricing.

Read: Top 20 Chatbot Analytics

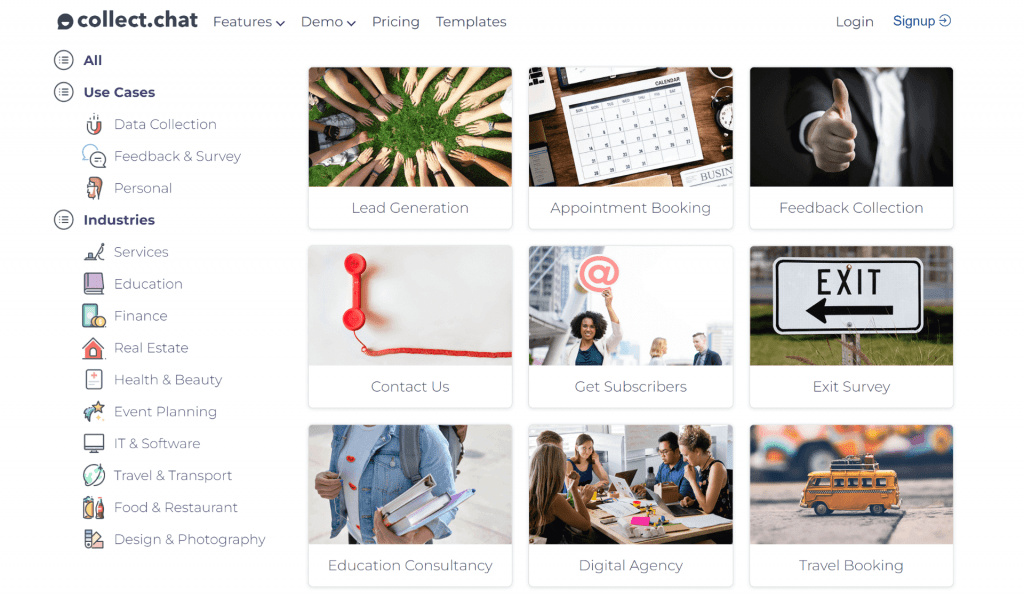

6. Collect.chat

Best for Multilingual Support

I used collect.chat to create a chatbot for my finance website, and I was amazed by its ease and effectiveness. Collect.chat is a simple and beautiful chatbot tool that helps you generate more leads, sales, and conversions from your website visitors.

You can choose from a range of chatbot templates for different finance use cases, such as mortgage surveys, insurance assistance, merchant service, etc.

One of the best features of collect.chat is its multilingual support. You can create chatbots in any language you want and reach out to customers from different regions and backgrounds. You can also get instant notifications and data from your chatbot via email, dashboard, or integrations.

Collect.chat is a great chatbot tool for finance websites. It helped me increase my conversion rate and save time and money on lead generation. I highly recommend it to anyone wanting to grow their online finance business.

What you’ll like:

- Chatbot analytics and dashboard to view and export your chatbot data.

- Drag-and-drop builder to create interactive and engaging chatbot surveys and forms.

- Integration with popular platforms, such as Google Sheets, Mailchimp, and WordPress.

- Chatbot automation and scheduling features to send timely messages to your audience.

What you may not like:

- Unresponsive customer support.

- The platform has restricted access and control of the chatbot data, which makes it hard to export and analyze the data.

Pricing: A free plan is available (without team collaboration feature). Paid plan starts at $24/month.

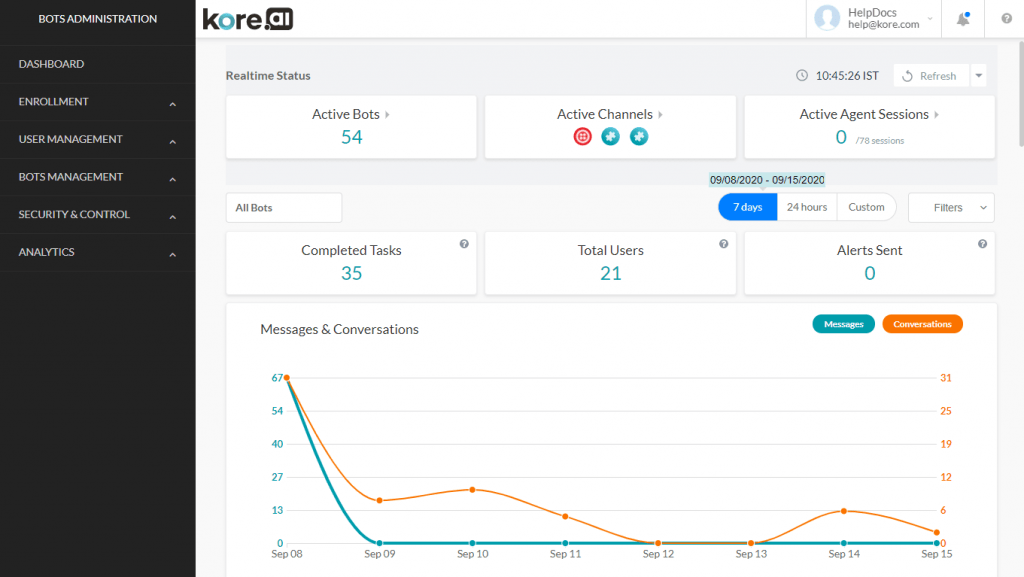

7. Kore.ai

Best for Voice Functionality

I used Kore.ai as a finance chatbot for my banking needs, and I was impressed by its features and performance. Kore.ai is an AI-powered platform that allows you to create custom bots that integrate with various systems, automate tasks, and provide customer service.

One of the best features of Kore.ai is its ability to offer conversational banking through a wide range of voice and text channels. I could easily access my account details, make payments, review transactions, and get personalized recommendations from Kore.ai.

The bot was very user-friendly, responsive, and accurate. It also allowed me to connect with a live agent whenever I needed more assistance. Kore.ai helped me save time and money and improved my banking experience. I recommend Kore.ai to anyone looking for a smart and reliable finance chatbot.

What you’ll like:

- Live agents assists with complex inquiries.

- Advanced analytics specifically designed for the finance sector.

- Product recommendations to customers looking for new accounts, upgrades, etc.

- Balance management like check verification, account hold release, and stop payment requests.

What you may not like:

- Limited options to customize the chatbot as compared to competitors.

- The platform has a high cost and investment, which makes it hard to justify the value and benefit of the platform.

Pricing: Starts at $1.72/conversation.

Read More: 21 Best Chatbot Software: Top No-Code Picks for 2025

Our Evaluation Criteria

The evaluation of products or tools chosen for this article follows an unbiased, systematic approach that ensures a fair, insightful, and well-rounded review. This method employs six key factors:

- User Reviews / Ratings: Direct experiences from users, including ratings and feedback from reputable sites, provide a ground-level perspective. This feedback is critical in understanding overall satisfaction and potential problems.

- Essential Features & Functionality: The value of a product is ascertained by its core features and overall functionality. Through an in-depth exploration of these aspects, the practical usefulness and effectiveness of the tools are carefully evaluated.

- Ease of Use: The user-friendliness of a product or service is assessed, focusing on the design, interface, and navigation. This ensures a positive experience for users of all levels of expertise.

- Customer Support: The quality of customer support is examined, taking into account its efficiency and how well it supports users in different phases – setting up, addressing concerns, and resolving operational issues.

- Value for Money: Value for money is evaluated by comparing the quality, performance, and features. The goal is to help the reader understand whether they would be getting their money’s worth.

- Personal Experience/Expert’s Opinion or Favorites: This part of the evaluation criteria draws insightful observations from the personal experience of the writer and the opinions of industry experts.

Also Read: 13 Best Customer Service Automation Software for 2025

Find the Best Finance Chatbot for Your Business in 2025

Though I have provided you with the 7 best finance chatbots available on the market, it can still be hectic to choose the right one for your business. Thus, I am cutting down my list to the top 3 recommendations to ease your task.

Option A: ProProfs Chat

ProProfs Chat can be your best bet if you are looking for an AI-powered chatbot solution that can help you automate your support process. This versatile platform comes with a lot of dynamic features like bot performance reports, intelligent chat routing, stored chat transcripts, automated greetings, and multiple integrations.

Option B: Collect.chat

If you are looking for a chatbot that can help you connect with a wide audience with a diverse linguistic base, Collect.chat can be your tool to go. This multilingual chatbot comes with comprehensive analytics and a simple-to-use drag-and-drop builder.

Option C: Kore.ai

Kore.ai can be a good option if you are looking for a voice-enabled chatbot solution. This software comes with powerful analytics to help you improve your chatbot performance and support efforts.

Ultimately, the best finance chatbot for your business depends upon your specific requirements.

However, if you want to get a reliable and affordable solution, I suggest you use ProProfs Chat.

This forever-free platform lets you use it without investing your money. This way, you can test how effective a chatbot can be for your finance business without paying a penny.

Learn More About Finance Chatbots!

Q: What is a finance chatbot?

A finance chatbot is an AI-powered tool that assists users with financial queries and transactions through natural language conversation. It leverages machine learning and natural language processing to understand and respond to user inquiries, provide information on financial products, manage transactions, and offer personalized financial advice.

Q: What are some of the top use cases of finance chatbots?

Finance chatbots excel in tasks like account inquiries, transaction processing, bill payments, investment advice, and budget management. They streamline customer support, enhance user engagement, and facilitate 24/7 assistance, making them invaluable for banks, insurance companies, and other financial institutions.

Q: What are the benefits of finance chatbots?

Finance chatbots offer efficiency by automating routine tasks, improving customer service with instant responses, and providing personalized financial guidance. They reduce operational costs, enhance user experience, and ensure data security. Additionally, chatbots enable businesses to scale their services and stay competitive in the rapidly evolving financial landscape

Tips

Tips

We’d love to hear your tips & suggestions on this article!

FREE. All Features. FOREVER!

Try our Forever FREE account with all premium features!

We'd love your feedback!

We'd love your feedback! Thanks for your feedback!

Thanks for your feedback!